How Automation Is Transforming FinTech

MORITZ PUTZHAMMER

19 August 2022 • 13 min read

Table of contents

FinTech has already transformed your personal and professional life, and the most extraordinary thing is that you haven’t even noticed it.

We’ve become so accustomed to the ease, convenience, and instantaneousness of banking, finance, and consumer-related applications and software that they’re now second nature. Having blended into the landscape of our daily lives, we simply take them for granted.

Once considered to be the black sheep of the financial world, FinTech has become a household name. The “disruptor” has gone mainstream, and it happened in the blink of an eye.

Despite FinTech’s ubiquity, though, you might still have some questions. What are the differences between FinTechs and banks? Will FinTech eventually replace traditional banks? And what’s the role of automation in FinTech?

Let’s start with some basics.

What Is FinTech?

FinTech is how you hail a taxi, receive your salary, pay your bills, or trade the financial markets with your phone. It’s cryptocurrencies, digital tokens, and digital cash. It’s the power of automation, artificial intelligence, and machine learning at your fingertips.

A portmanteau, FinTech is the combination of two words: finance and technology. Something of a catch-all term, it generally refers to the many mobile applications, software programs, and related technologies that improve existing forms of finance for both businesses and individuals through the power of automation. Think trading platforms such as Trality, digital banks such as N26, peer-to-peer payment services such as Venmo, and “robo-advisors” (automated portfolio managers) such as Wealthfront.

A Brief History of FinTech

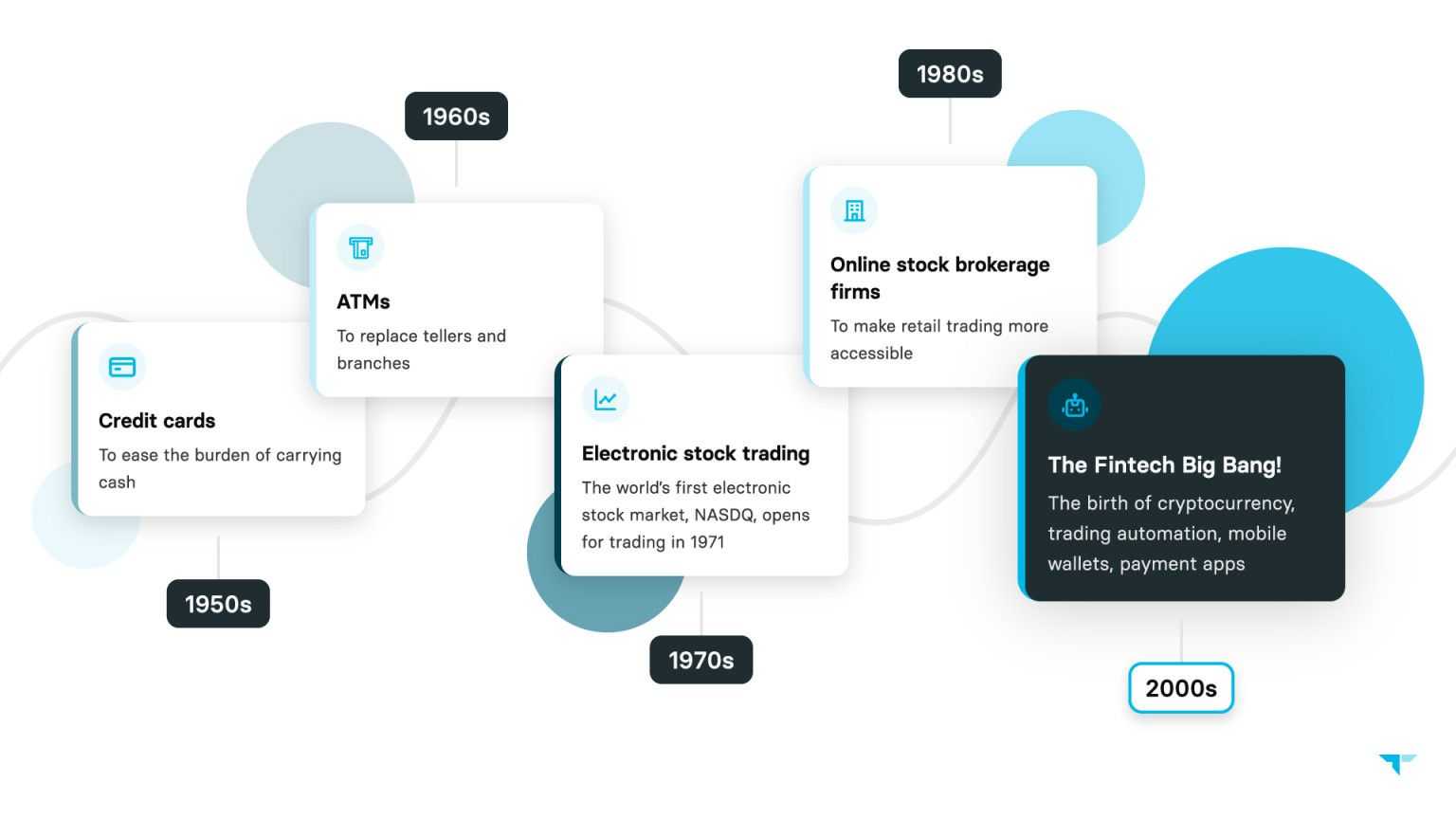

While FinTech is undeniably the future, its many recent innovations belie a history that dates back at least to the 1950s (although some go as far as dating it to the 1860s). It wouldn’t be an exaggeration to say that, with their introduction of the first credit card, Diner’s Club Inc. changed the course of financial history.

And FinTech’s future is shaping up to be as impressive as its past. According to one study, approximately $1.5 billion was invested in blockchain in 2018, while global investment is projected to grow by roughly ten times in 2023 to an estimated $15.9 billion.

What is Automation in FinTech?

Automation is defined as the use of machines and computers that can operate independently of human control, with a textbook example of FinTech automation being the use of crypto trading bots.

Whereas the vast majority of individual investors trade crypto manually, often unsuccessfully trying to time the market based on fear of missing out (FOMO), financial institutions have been using the power, efficiency, and objectivity of automated trading for decades and the results speak for themselves. In a report by the Office of the New York State Comptroller, Wall Street profits were near record levels as recently as late 2021 before the market downturn.

Automation in FinTech is the driver behind the improvement and ease of services such as money transfers and payments, financial planning, budgeting, investments, savings, insurance, and borrowing, among many other things. Rather than depending on human input, automation vastly simplifies financial transactions, which become more affordable, more accessible, and more inclusive as a result (e.g., serving the needs of the unbanked and under-banked).

The Rise of Automated Trading Bots

One of the most innovative uses of automation in FinTech are trading bots, which continue to transform the way that individual or retail traders approach investing.

Until recently, individuals have only had recourse to manual trading, which is unreliable, slow, subjective, and inefficient. Large financial institutions on Wall Street and elsewhere, on the other hand, have benefitted from automated trading for decades, which explains their tremendous gains. However, the disruptive power of FinTechs such as Trality are now leveling the playing field by offering professional-grade trading tools to anyone who needs them. Let’s take a brief look at automated trading bots to learn more about them, their benefits, and how they are transforming trading.

What are crypto trading bots?

Think of crypto trading bots as high-powered intermediaries between you and a crypto exchange such as Binance. A crypto trading bot is basically an automated program that performs repetitive trading tasks more efficiently than humans. A more precise definition might be expanded to include the fact that crypto trading bots execute functions using machine learning (ML) and artificial intelligence (AI) based on a set of predefined rules. And there are many different types of crypto trading bots, including arbitrage, coin lending, coin lending, margin trading, market making, and technical trading bots.

The basic mechanics of a crypto trading bot involve four primary stages: 1) data analysis, 2) signal generation, 3) risk allocation, and 4) execution. With the power of machine learning software, crypto trading bots can analyze and interpret tremendous amounts of data, far exceeding anything that human beings are capable of processing. By using technical analysis indicators and the aforementioned market data, crypto trading bots then generate trading signals as well as distribute risk based on the individual user’s input according to their risk tolerance(s). And the final step, then, involves the actual buying and selling of cryptocurrencies, which occur in an automated manner based on the specifications established in the preceding steps.

What are the benefits of crypto trading bots?

The first thing to know is that there are many benefits to using crypto trading bots, which is precisely why large institutional financial companies have been using them for decades. If you’re an individual trader, then you should only be buying and selling crypto using crypto trading bots. It is virtually impossible to time the market (please re-read that sentence again).

The crypto market is open 24/7/365, making it exceptionally difficult for casual investors to identify the best time of day to buy crypto. When equipped with automated trading tools such as crypto trading bots, you are ensuring that you never miss trades or trading opportunities. Their many benefits include emotionless trading, high trading speeds, back testing and paper trading, risk diversification, and trading discipline.

Perhaps you’re interested in the most undervalued cryptocurrencies. Or maybe you just want to add some new crypto coins to your portfolio. Crypto trading bots offer maximum flexibility, enabling traders to buy, sell or hold assets in a disciplined and objective way any time of day from anywhere in the world.

Automated Crypto Trading with Trality

Headquartered in the heart of Europe, Vienna-based Trality envisions a future in which everything is automated by bots. And when it comes to automated investing specifically, Trality exists to bring automated, algorithmic trading to all who need it.

While most investors are losing out due to emotional trading or poor timing, the upper echelons of the financial world are raking in the profit thanks to advanced, automated systems, which is why Trality is proud to offer its innovative, one-of-a-kind automated trading tools for retail investors.

The Trality Marketplace

Trality’s Marketplace is a unique space that brings together crypto trading bot creators and investors for mutually beneficial purposes. Until now, investors have had to rely on platforms that use anonymous bot makers and unproven bots. However, Trality’s Marketplace is an expertly curated space with hand-picked creators and the best bots available, enabling both creators and investors to earn solid passive income returns.

Investors can rent profitable bots tailored to specific risk tolerances (low, medium, and high) and individual investment goals. A full suite of metrics is available, allowing investors to decide on a bot based on clear, quantifiable data. Bot Creators can monetize their bots and earn passive income from investors around the world by having their bots listed on Trality’s Marketplace.

Trality’s Rule Builder

One of Trailty’s core product offerings, the Rule Builder is intended for crypto traders with little-to-no coding experience. Its clean, elegant design means that users can transform their trading ideas quickly and easily into a profitable strategy using professional-grade tools.

With its intuitive graphical user interface, the Rule Builder is a simple yet powerful rule-based bot creation editor, one that lets traders build and automate algorithmic trading bots by dragging and dropping technical indicators based on boolean logic. With over 100 technical indicators from which to choose as well as a variety of predefined strategies, traders can customize their bots with ease based on their own individual needs.

Once the desired setup has been achieved, traders can then analyze their strategy with Trality’s blazing-fast backtester, which employs a variety of commonly used statistics to gauge 1) performance (e.g., profit and loss; total return; average profit per winning trade), 2) risk/return (e.g. volatility; Sharpe ratio), and 3) runs (e.g. maximum drawdown; time under water).

Trality’s Code Editor

One of Trality’s marquee product offerings, the state-of-the-art Code Builder is the world’s first browser-based Python code bot editor. It is designed for experienced traders who want to develop sophisticated trading algorithms using the latest technology.

Python programmers will feel at home using the Code Editor’s full range of powerful tools and innovative features to create and backtest their algorithms. In-browser editing with intelligent auto-complete as well as in-browser debugging provide a seamless process for the development of trading ideas and their eventual realization as profitable trading bots.

With a full range of technical analysis indicators and a growing number of libraries, including NumPy, the Code Editor provides maximum flexibility for customizing bots based on a variety of market conditions and a variety of short- and long-term trading goals.

Blazing-fast, in-browser backtesting also means that testing and fine-tuning algorithms can be done quickly and easily. Benefit from clear versioning and backtest history, while also having access to financial data with easy-to-use API.

Is Trality safe and secure?

All strategies and algorithms created with the Rule Builder and Code Editor are completely end-to-end encrypted, and all bots created on Trality’s platform meet strict security and privacy standards. Traders’ funds remain safe on their chosen exchange, and Trality only uses withdrawal-disabled API keys.

Other important developments in automation and FinTech

For many, automation provides the disruptive recipe for the traditional banking sector and so-called “legacy” companies, but disruption has become something of a buzzword lately. The word itself denotes radical, systemic change (think the printing press or the internet), which tends to be infrequent. As we all know, technology has been used to reduce or even limit human intervention for centuries.

Rather, what we mean when referring to the transformation of FinTech as a result of advances in automation is more a matter of evolution rather than revolution. How does automation make processes more streamlined, efficient, profitable, accessible, adaptable, safer?

Generally speaking, automation is transforming the FinTech sector in the following key ways:

- Fraud detection and reduction

- Reduction in operating costs

- Real-time data processing (e.g., loans)

- Increased transparency and accuracy in terms of regulatory compliance

- Increased volume for payments reconciliation

Let’s take a closer look at some of the most important developments in automation and FinTech.

Artificial Intelligence (AI)

Artificial Intelligence (AI) is a crucial component of the FinTech ecosystem. In fact, it’s become so important to FinTech and legacy companies alike that it is now used in processes such as loan decisions, fraud detection, customer support, credit risk assessment, and the creation and management of wealth.

Data, for example, is still king, and virtually every FinTech is harnessing the power of big data via automation. Rather than simply being able to scan documents as earlier iterations of AI could do, current versions use deep learning (more on machine learning below) to scan and screen incredible amounts of data to ensure regulatory compliance. Two prime examples are Know Your Customer (“KYC”) compliance and anti-money laundering (AML) checks, which fall under the umbrella term “RegTech.” Artificial intelligence is also behind the success of “InsurTech,” or the insurance industry’s use of technology in order to improve its processing and verification of claims.

Academic research into artificial intelligence continues apace. In their survey of FinTech research and policy discussions, researchers from Imperial College London and the University of Pennsylvania included a section on the use of automation in enhanced systems for credit scoring using AI/ML, the roles of marketplace lending and peer-to-peer (P2P) lending, and digital banking and investment services. As crypto achieves more widespread adoption in the years to come, expect to see significant growth in this class of software applications to manage local and international compliance as well as automate financial transactions between peers and among institutions.

Machine Learning (ML)

With a headline like “Why Machine Learning Has Huge Potential in Fintech,” even the most near-sighted trend spotter will recognize the value and importance of machine learning for the space. Remember what we said about data? As ever more aspects of life become bits of data to be stored, traded, sold, analyzed, and quantified, FinTech companies will become increasingly reliant on the tremendous power and capabilities of machine learning to do what humans simply cannot do.

According to one estimate, machine learning is expected to reach $80.3 billion in revenue by 2023. While the increased use of ML within the healthcare industry has fueled a considerable portion of this growth, machine learning continues to see significant use within the FinTech sector, particularly in payment reconciliation. With the shift to online commerce and digital payments, companies have been struggling to process payments in a timely manner. Somewhat counterintuitively, complex data reconciliations typically involve manual checking by humans, but ML has the potential to reshape the process by offering substantially improved speeds and accuracy.

Closer to home, researchers continue to explore the use of machine learning in crypto trading. Given crypto’s notorious volatility, academics are trying to determine the extent to which machine learning can be used to predict the profitability of cryptocurrencies using trading strategies designed with machine learning techniques (e.g., linear models, random forests, and support vector machines). Crucially, such models are tested in bear markets in order to determine the relative merit of these predictions under different market conditions.

Robotic Process Automation (RPA)

As its name suggests, robotic process automation (RPA) is a type of automation technology that employs software robots and/or AI, typically to accomplish repetitive or rule-based tasks in order to save money, ensure consistency, and reduce the frequency of errors. RPA has a wide range of applicability across various aspects of FinTech (and traditional finance) operations, including banking and finance process automation, mortgage and lending processes, customer care automation, eCommerce merchandising operations, optical character recognition applications, data extraction process, and fixed automation process, among others, making RPA something of a paradigm of interoperability.

However, given the compartmentalization of business and IT departments at legacy institutions, RPA is often implemented ineffectually. FinTechs, on the other hand, are technology-driven by design and RPA offers real advantages in terms of freeing up the workforce from repetitive tasks, allowing them instead to focus more on projects that require greater degrees of complexity and creativity. When instituted early and company-wide, FinTechs can expect to see a return on investment within three to nine months, with some analysts forecasting that RPA will become near universal in the next two years.

Today’s Fintechs are already using RPA to streamline a variety of business processes. Compliance workflows are often time-consuming and RPA can optimize onboarding and workflows with automated solutions. Rather than sifting through reams of documents during a verification process, FinTechs are now offering verification automation that expedite the process for banks and lenders. Similarly, e-invoices have become increasingly popular lately and a number of RPA-based invoice validation platforms have emerged to reduce the amount of time it takes companies to process and validate these invoices. Companies can often have multiple bank accounts in multiple jurisdictions, and FinTechs have started to offer multibanking solutions based on automation, which provide central financial data management, real-time liquidity insights, and trouble-free in-house transfers. RPA is even being used to increase the ease and accuracy of filing taxes.

It’s easy to see why robotic process automation will be integral to the transformation of FinTech in the years to come.

Natural Language Processing (NLP)

Natural language processing has broad applicability, from the healthcare industry and legal sectors to finance. As I write this article, the software that I’m using is quietly making suggestions with predictive text—a simple example of the power of natural language processing, deep learning, and artificial intelligence.

Hello, my name is Bob. How can I help you today? I’m sorry, I did not understand your request. We’ve all had the pleasure of interacting with a chatbot, one that invariably doesn’t have the answer to our questions (but nevertheless wastes our precious time). Powered by the latest developments in natural language processing, the next generation of chatbots are turning banking customer service into “conversational banking,” or digital banking via voice, text messaging applications, or visual engagement tools. These automated chatbots now have the ability to understand context, analyze the sentiment within a text, and perform predictive analysis. FinTech-provided NLP software is assisting banks to provide their customers with bank account management as well as alerts when spending limits are reached or payment anomalies are detected.

As with machine learning and artificial intelligence, academic research is driving the latest developments in natural language processing and FinTech. Researchers in Taiwan have examined the application of NLP technologies under three specific scenarios: Know Your Customer (KYC), Know Your Product (KYP), and Satisfy Your Customer (SYC), while elsewhere researchers are examining the use of NLP and FinTech for poverty alleviation and sustainable development for Muslims in India (to cite only two recent research examples).

Extreme Automation (XA), Hyper Automation, Intelligent Automation

Just as there are many different types of crypto trading bots, so too are there many different types of automation, including extreme automation (also referred to as hyper automation and intelligent automation). Another umbrella term, extreme automation unites workers, processes, and tech in one seamless flow in which robotics and artificial intelligence play a crucial role. When complemented with extreme connectivity, these systems are capable of real-time interaction, exponentially magnifying the power of automation.

Given its transformative power, intelligent automation is having a big impact on the financial industry. Two researchers at the Norwegian School of Economics, for example, have explored how Norwegian providers of financial technology use intelligent automation in light of the revised Payment Service Directive (PSD2). According to their analysis, FinTech firms could improve all of the various aspects of their business model, including value creation, value delivery, and value capture, by taking advantage of intelligent automation. As they write,

While robotic process automation entails the use of bots to handle repetitive, high-volume, and rule-based tasks, artificial intelligence enhances the user’s ability to solve business problems by simulating human cognition using various algorithms, e.g., machine learning, natural language processing, and computer vision. Although robotic process automation often is deployed as a “patching tool” to deal with outdated legacy systems, our study reveals that it can yield extraordinary results.

Extreme automation (XA) promises to promote a digital-first world in which tech and day-to-day business operations are integrated in order to achieve positive growth in things such as consumer experience and revenues. And the pandemic has only hastened the need for implementing extreme automation. According to one estimate, the anticipated pre-COVID market for IPA (intelligent process automation) was thought to be approximately $10 billion by 2020, but that figure has since been revised to approximately $16.3 billion by 2025 due to unanticipated employee and consumer needs as a result of COVID.

Final Thoughts

By now it should be clear that automation will continue to have a transformative impact on the FinTech sector as well as the traditional finance and banking industries for years to come.

Digital banking will continue to see positive growth, as access becomes easier and the availability of services increases. Blockchain technology will continue to be adopted, as companies look for new ways to secure transactions in a transparent, verifiable manner. And advances in artificial intelligence and machine learning will allow companies to scale, as operating costs will become cheaper and services more user-friendly for consumers.

An additional benefit will see this technology becoming more affordable, and therefore more accessible, as its adoption increases.